Boost property risk insights with our site-link service

In the ever-evolving world of insurance, having the right data at your fingertips can be the difference between risk and reassurance. That’s why we’re excited to unveil our latest innovation—a service that gives insurers a clearer, more comprehensive view of the properties they underwrite.

What is it?

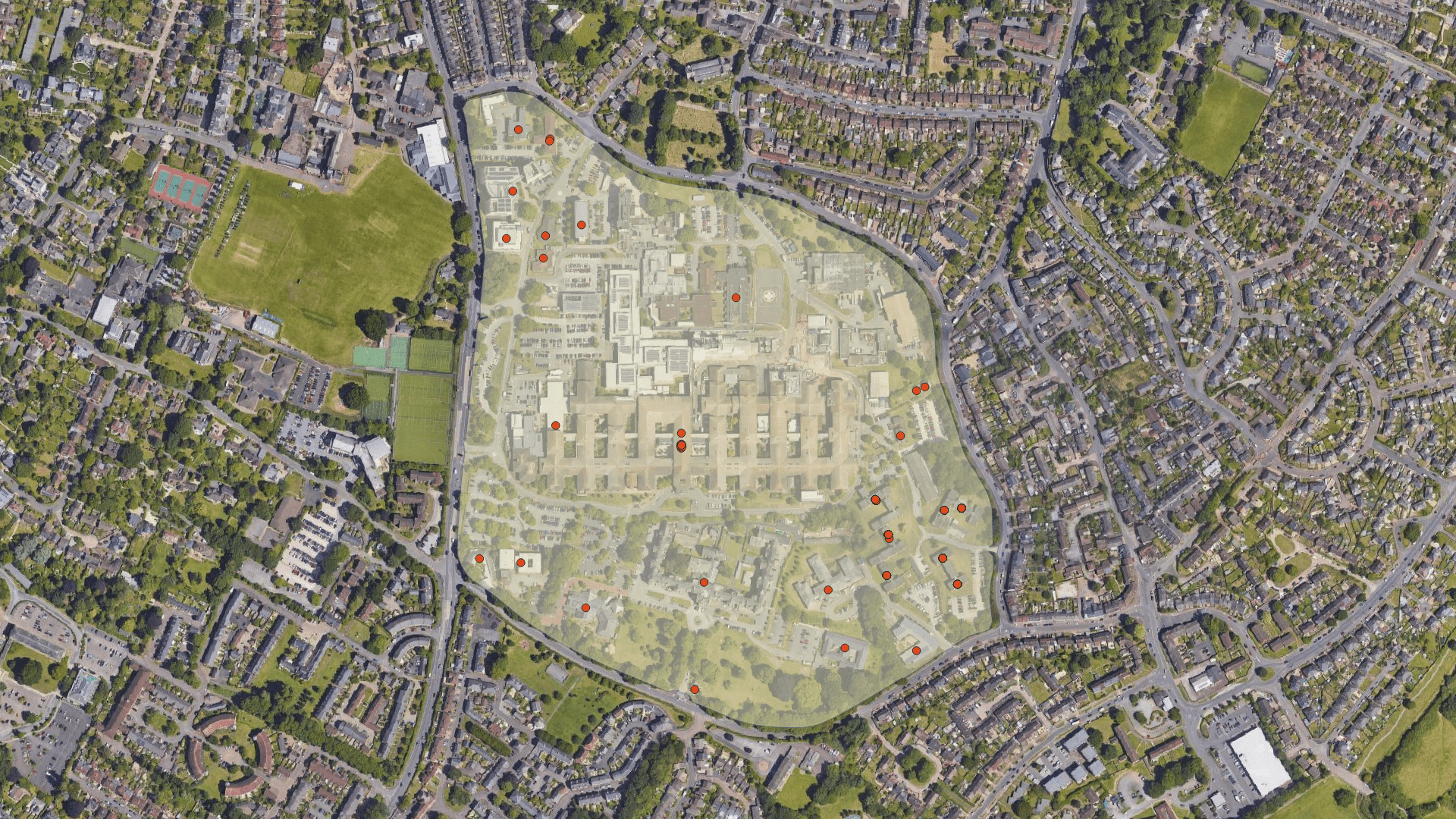

This new capability connects individual properties (UPRNs) to their broader site context, having been born from a simple client request and developed through close collaboration across our product and data teams. Whether you're insuring a single unit or an entire business park, the site-link service helps you understand exactly what’s within the site boundary.

At its core, the service enables two key capabilities:

- From Property to Site: Input an address or UPRN and discover the full site it belongs to, along with all other properties within that site.

- From Site to Properties: Provide a site reference and receive a complete list of all associated addresses/UPRNs. This bidirectional lookup gives insurers a more accurate picture of their exposure—especially valuable when underwriting complex or high-value sites.

- From there, we can also delve deeper into the specific Buildings associated with each Property (UPRN).

Why it matters for insurers

Without this level of insight, insurers often rely on fragmented data that can lead to dangerous blind spots.

Consider these scenarios:

- A shopping centre fire affecting 50+ interconnected retail units.

- Flood risk at a housing estate where shared infrastructure creates correlated exposure.

- Industrial accidents that could impact dozens of businesses within a single complex.

Who benefits most:

- Commercial and industrial insurers: Understand the full scope of business parks, warehouse complexes, or industrial estates.

- Specialist brokers: Gain clarity on complex sites like ports, airports, or medical centres.

- Catastrophe modelling teams: Avoid over- or underestimating risk by knowing exactly which properties lie within site boundaries.

- Portfolio managers: Identify and monitor exposure concentrations across your book.

Flexible access, scalable pricing

We understand that one size doesn’t fit all. That’s why the service is available in two formats:

- Offline delivery: Send us your UPRNs or site references, and we’ll return the matched data.

- API integration: For real-time underwriting workflows, connect directly to the service via our simple API and pay only for what you use.

We’re also exploring tailored subsets—such as all commercial or industrial sites—so you can access only the data that’s relevant to your portfolio.

Part of a bigger picture

This product is not just a standalone offering; it is part of our broader commitment to enhancing our UK data suite. It reflects our ongoing investment in innovation, our responsiveness to customer needs, and our ambition to support insurers not just with peril modelling but with deeper exposure intelligence.

Whether you’re underwriting a single site or managing a national portfolio, this solution gives you the clarity and confidence to make better decisions.

Ready to eliminate blind spots in your property underwriting?

Whether you're looking to enhance complex site assessments, refine your catastrophe exposure models, or simply gain clearer visibility into your portfolio concentrations, the site-link service delivers the insights you need.

Get in touch today to learn more, request a demo, or explore how this service can support your portfolio with smarter, site-level intelligence—plus, gain access to data samples that show the power of the site-link service in action.