The catalysts to pull the renewable fuel industry out of the slump

More than 50 stakeholders across the shipping value chain signed a Call to Action at COP29 1.

This joint statement calls for bolder action to increase zero and near-zero emission fuel uptake, investment in zero-emissions vessels, and global development of green hydrogen infrastructure. And is a commitment to increasing the uptake of zero- or near-zero-emission shipping fuels to at least 5%, striving for 10%, by 2030.

The Call to Action was signed by e-fuel producers, vessel and cargo owners, ports, and equipment manufacturers. It also received support from financers, demonstrating the strong momentum in the industry for decarbonisation investment and scalable zero-emission fuel (SZEF) pathways.

One of the Call to Action’s key recommendations is for a balanced approach to revenue distribution – bridging the cost gap between fossil fuels and SZEFs.

And momentum towards greater use of zero-emission fuels hasn’t waned. At its 83rd session, the Marine Environment Protection Committee (MEPC) paved the way for greater usage of non-carbon-containing fuel and approved the development of guidelines for the management of ammonia effluent generated by ships using ammonia as fuel 2.

Green hydrogen will be an important tool for decarbonising shipping, but global production must double by 2030 to align with a 1.5 °C pathway. This translates to an uptake of at least 5 million Mt of green hydrogen in the shipping sector, being an important enabler for decarbonisation.

Of course, the shipping sector is not the only sector looking at hydrogen-derivatives as a means to meet decarbonisation targets. Heavy industry applications, like steel production plants, which are unsuitable for electrification, can also benefit from hydrogen derivatives as a clean power source.

Another important use of hydrogen derivatives is as a carrier of clean energy from remote locations to energy hubs.

The cost of hydrogen is too high

While several clean energy initiatives are active within the industry, and many projects are in early planning phase, which was again underlined at the 2025 World Hydrogen Summit in Rotterdam, the realisation of actual projects is unfortunately limited as many projects end at the drawing board. The main reason for this is affordability.

Renewable fuels are less economic than conventional oil and gas. They cost more to generate, they require several conversions, and developing appropriate infrastructure for their storage and transport requires extra investment.

Let’s focus on the cost of infrastructure. To support SZEFs, the sector needs to invest in building a full supply chain in an uncertain market, with no guaranteed return on investment.

End users are sitting on their investment until the shortage of supply is resolved. Someone needs to pay the initial bill, and each player is looking at the other to do so: “Consumers need to pay”, “Big firms have deep pockets”, “Subsidy should be the enabler”.

As a result, investments are often stalled.

There are two solutions to get the ship moving and get renewable fuel investment out of the impasse:

- Blue hydrogen

- Scalable solutions

The support for scalable solutions is reflected in the key recommendations of the Call to Action. And although blue hydrogen is not, we see both as vital contributors to realising the clean energy shift.

Today’s return on investment is tomorrow’s sustainable world

Blue hydrogen is hydrogen produced from conventional sources like oil and gas, but without CO2 emissions due to carbon capture and storage. Green hydrogen is hydrogen produced from renewable resources such as solar and wind.

Opponents claim that blue hydrogen obstructs a renewable future, as blue hydrogen developments are clearly linked to oil and gas investments. However, globally we’re still investing in and producing oil and gas resources, as the recent directives of the new US president have again underlined.

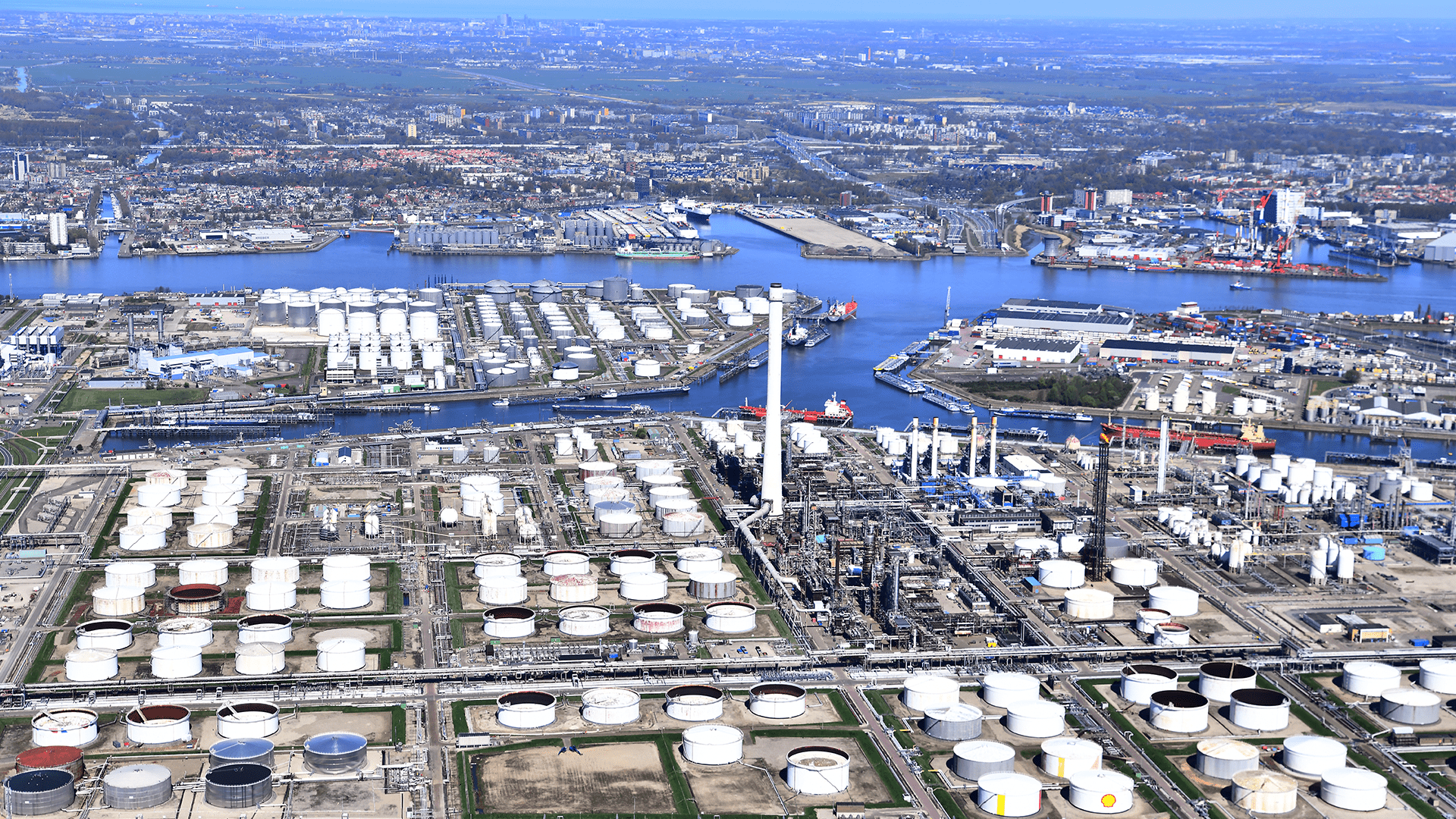

The investments in a blue hydrogen supply chain would be focused around an area with excess gas, existing oil and gas infrastructure, and potential storage locations. These locations cannot be used for green hydrogen, as they have different environmental and structural requirements.

But it’s not simply a case of blue or green hydrogen. The required investment in blue hydrogen infrastructure will likely open the road for green hydrogen in the future. The same ships, pipelines, and tanks are needed regardless of whether the hydrogen derivative is green or blue.

Blue hydrogen is more competitive, so there is a considerably better outlook for return on this investment. Plus, the more hydrogen and related infrastructure is available, the more demand will develop. And with a higher demand, the competitiveness of green hydrogen also increases, as well as the willingness to invest.

Start small and grow

The question of how to kickstart investment remains. Do we ask investors for billions at the start, or could there be way for the required investment to follow the growing demand?

Achieving a more phased approach to investment relies on scalable infrastructure, and this can be achieved in several ways:

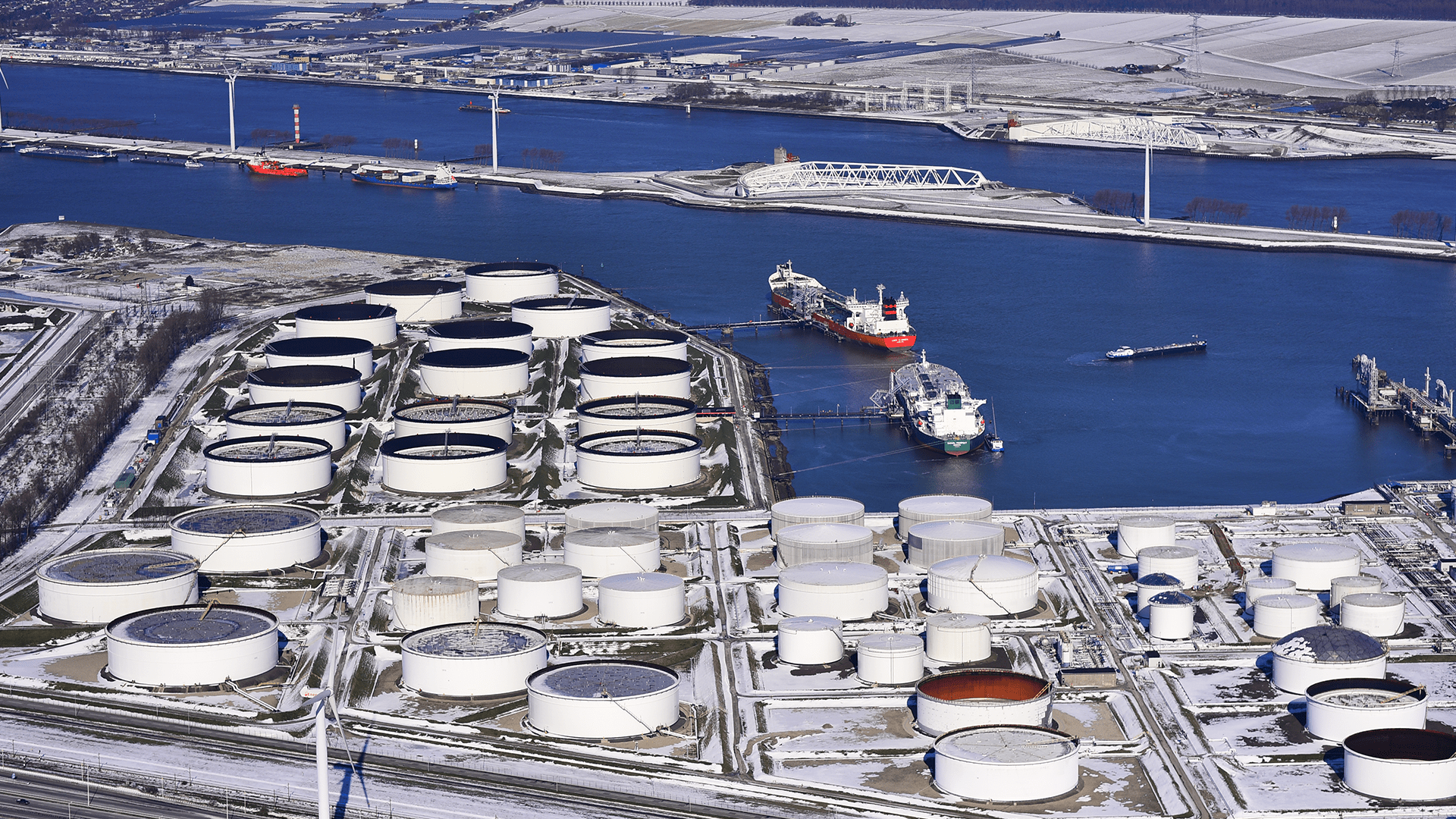

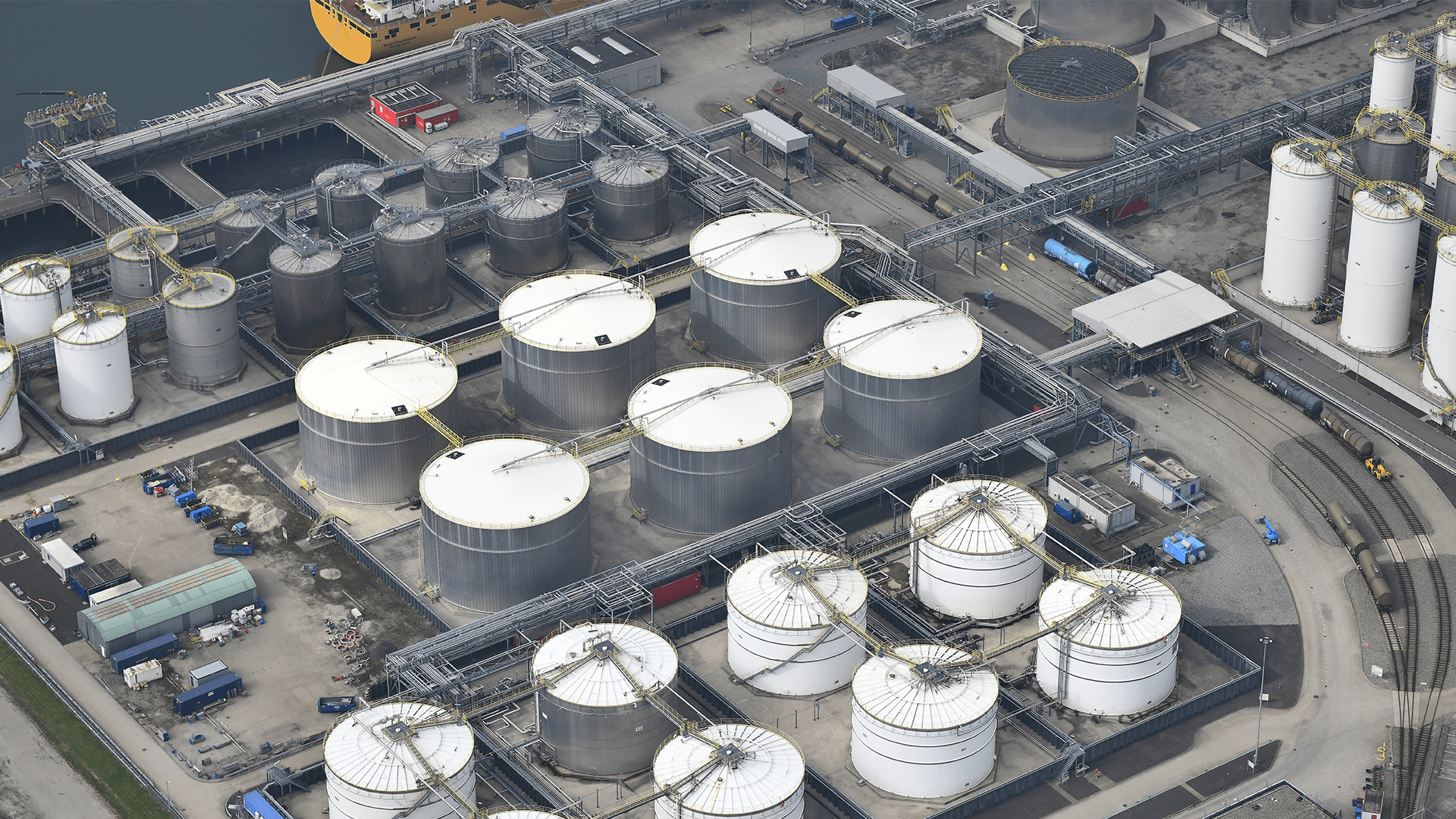

Re-purposing existing infrastructure. This might be the most economical solution depending on the specific features of existing infrastructure, such as the location within the built environment and the specifics of the product. Often the previous functionality of the existing infrastructure remains intact, strengthening the business case.

Floating offshore solutions, like buoy mooring and loading solutions or floating storage, regassification, and cracking units. These are currently on several drawing boards, building on the lessons learned from the LNG industry and could be made available and occupied flexibly. Such solutions avoid the need for building a full port.

Temporary, reusable solutions for smaller quantities. These solutions need to be considered carefully for the specific situation and conditions. Examples could be:

- Transport in ISO-containers, lifted on and off the ships deck, avoiding the need for pipelines

- Storage bullets, avoiding the need for full containment tanks

- Jack up platforms, avoiding the need to build jetties and offshore platforms

- Modular electrolyser and fuel production facilities

Testing grounds for new energy technologies. Such a test bank has proven to be a strong enabler for successfully bringing innovations to a higher maturity level. The ideas would be that the testing facilities, for example cryogenic, would be provided through subsidised shared investment. Multiple participating contractors or equipment manufacturers can participate in such a testing ground, partially at own cost and partially through funding by the organising entity, which could be government, port authorities or facility owners.

It’s time to energise renewable fuel investment

The Call to Action at COP29 shows clear industry support towards developing green hydrogen infrastructure. Besides a lack of strong consistent governance, the cost cap to fossil fuels and uncertainty on the demand side are two main showstoppers for this well-needed development.

Unfortunately there’s no silver bullet to solve the impasse, but blue hydrogen and scalable infrastructure solutions could be two strong enablers to ultimately make the transition to green hydrogen happen.

If you want to talk to our experts about the role you can play in the hydrogen industry, please get in touch. Or take a look at our hydrogen consultancy services for a broad idea of how we can support you.

1 https://www.lr.org/en/knowledge/press-room/press-listing/press-release/2024/lr-mdh-joins-call-to-accelerate-adoption-of-zero-emission-fuels-by-2030/

2 https://www.imo.org/en/MediaCentre/MeetingSummaries/Pages/MEPC-83rd-session.aspx