US tariffs deliver uncertainty in port development and planning

Uncertainty is the only sure thing when it comes to the impact of US imposed and reciprocal tariffs. Last month, the Trump administration implemented a 10% tariff on imports of goods from all countries except for Canada and Mexico, who face a mix of higher tariffs, and China who, at the time of writing, face tariffs at around 30%. The tariffs are a 90-day reprieve from the significantly higher tariffs announced by the US administration on April 2nd, 2025, that ranged between 10% and 150%.

Trying to stay up to date with the latest tariff escalations and de-escalations, understanding which goods are impacted when tariffs come into effect, the rates and compliance requirements is an almost fruitless exercise due to the rapid pace of change of events. Recent bilateral trade agreements indicate that the tariffs are unlikely to return to the levels announced on April 2nd though uncertainty remains. This is evident with the increase of tariffs on steel and aluminium which was raised to 50% for almost all trading partners on June 3rd.

Trade impacts

It is anticipated that the greatest trade impacts will be felt in the US and subsequently with China, Canada and Mexico though renegotiation of the USMCA agreement planned for 2026 might change this again

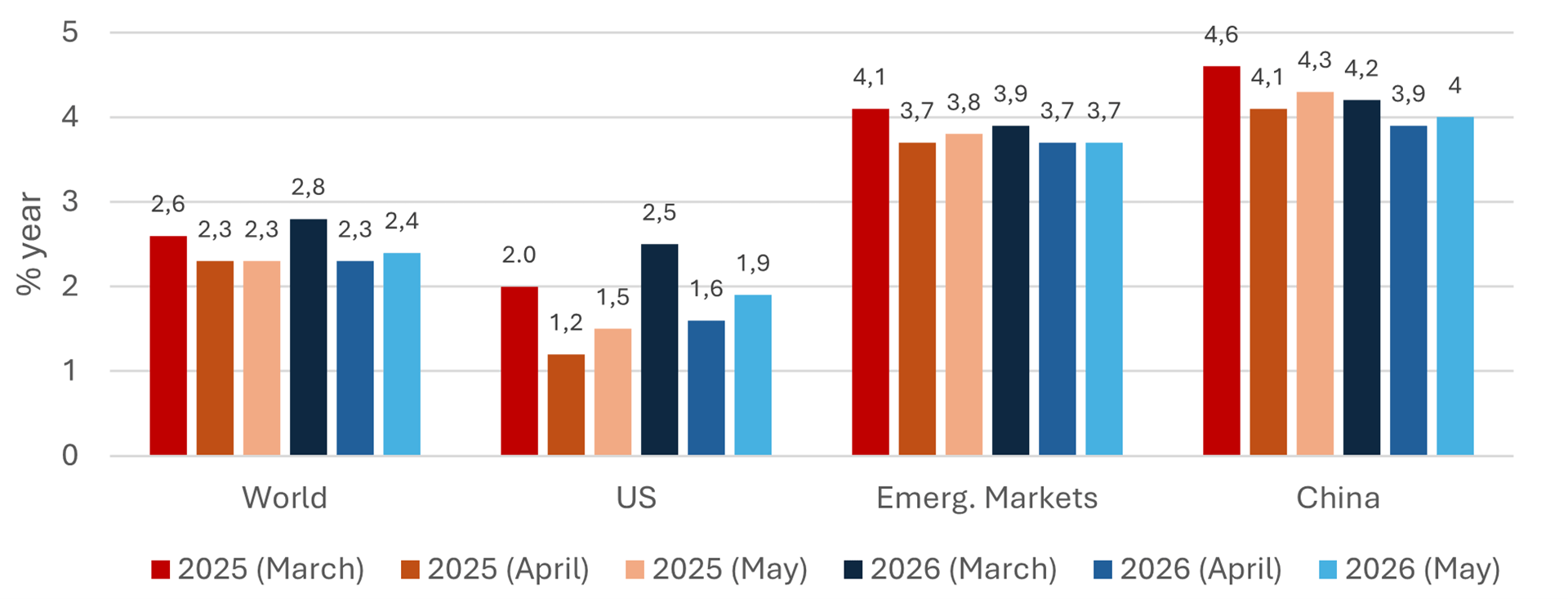

Oxford Economics, a reputable source of economic data, information and forecasts, sees no winners in the trade war noting that “every economy is a loser from the US’s dramatic policy shift,” however, the biggest losers outside of the US are expected to be China, Canada and Mexico due to the extent of the tariffs on these countries’ exports and their exposure to the US. Oxford’s latest GDP forecast (End May 2025) on the impact of the tariffs on GDP is presented in the below chart. Oxford has revised the GDP forecast up following the pause in US-Chinese tariffs and they expect tariffs to remain at the level of the temporary rates as bilaterial agreements are reached.

World GDP Forecast Revisions

Source: Oxford Economics

Adapting to new trade dynamics

Ports and logistics providers are in ‘wait and see’ mode as global trade dynamics continue to adjust in response to the tariffs. Drops in global trade volumes, reallocation of cargo and vessels and relocation of production are likely developments.

For ports and logistics providers, dusting off the crystal ball to make sense of the possible impacts on their business is proving difficult. Tariffs imposed by the Trump administration are some of the highest and most wide-ranging tariffs imposed in recent history and we are poised to see changes to global trade dynamics like never before. Sentiment in the industry is to wait and see, resulting in a slowdown in investment and delayed growth plans.

Global trade volumes are expected to fall as US demand reduces due to higher prices from US and reciprocal tariffs with the US National Retail Federation forecasting a 20% fall in US imports year on year from June.

Trade shifts are expected as goods previously bound for the US seek alternate markets and producers seek new locations with a lower tariff exposure.

When the dust settles, operators can expect to see lower volumes globally with the largest impact felt by those with exposure to US China trade.

Navigating the tariff-induced trade shifts

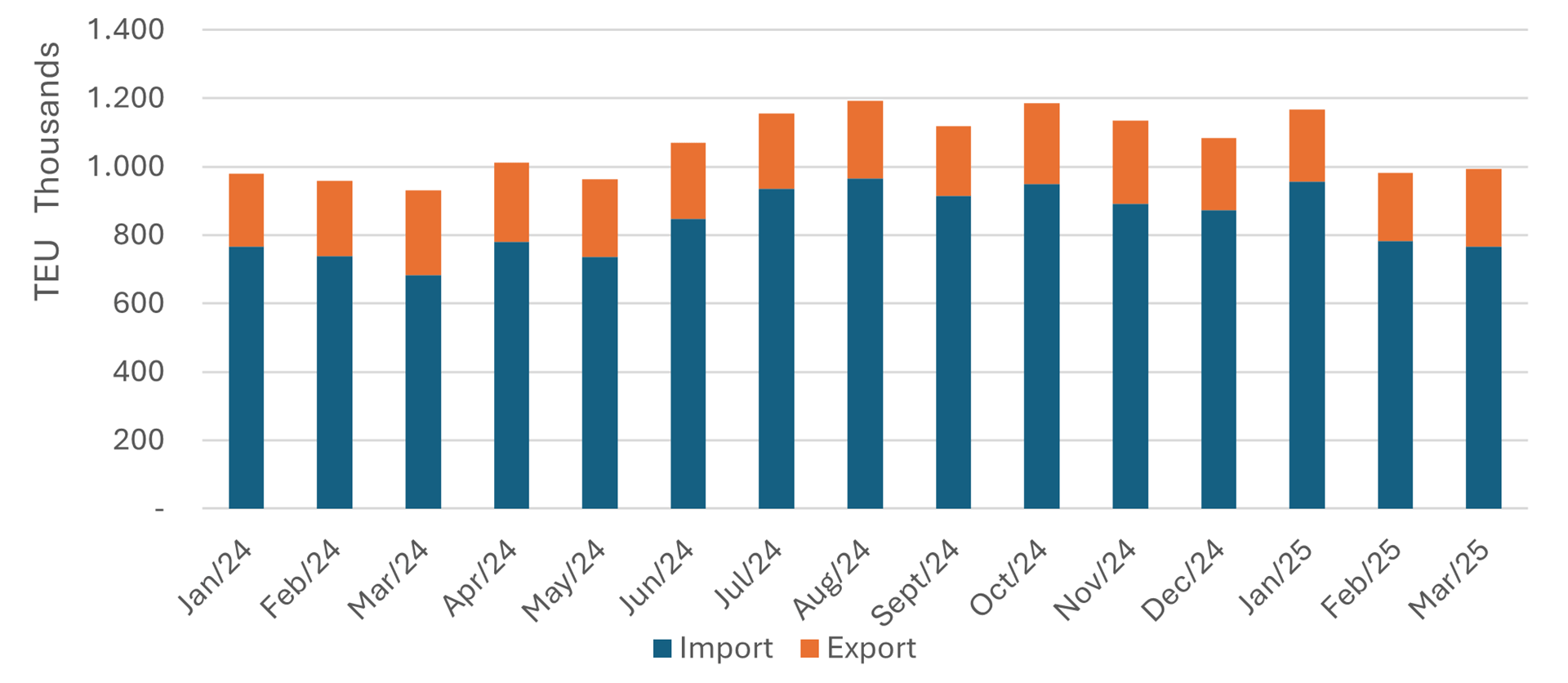

Initial reports of the tariff impacts focused on the front loading of container volumes from January to April as cargo owners aimed to get ahead of the tariffs with the Port of Los Angeles reporting record volumes for the month of January. This surge was followed by expectations of a significant slowdown with logistics firm Flexport reporting that China to US shipping expected 50% cancellations at the end of April however the actual cancellations were only 26%. Flexport expects the pause in tariffs and agreements between the US and China will result in a continued reduction in cancellations in the short term.

While China to US container volumes have, somewhat surprisingly, remained stable and followed cyclical trends in recent months, it is important to consider the lag between the introduction or change in tariffs and a change in port volumes due to sailing times. It can take between 10 and 40 days for container ships to sail from China to the US and therefore ports on this route can expect a delayed impact to volumes with significant volatility.

Laden container volumes handled at the Port of Los Angeles and Long Beach

Strategic adaptation for ports and logistics providers

Ports and logistics providers are seeking ways to make sense of the changing trade dynamics and to determine what steps they can take to mitigate any reductions in volumes.

Opportunities exist to shift focus and invest in areas that adapt to uncertainty and optimally position operations for when uncertainty subsides, including, for example, the following topics:

- Seek scalable operational enhancements: Direct investment towards scalable operational efficiency gains instead of new infrastructure. Scalable operational investments to improve throughput, reduce cost and improve quality offer long term value that can be incorporated into future infrastructure investments when uncertainty subsides.

- Engagement with key customers to identify volume impacts: Engagement with key customers is key to understanding the challenges faced by the introduction of the tariffs. Providing customers with greater flexibility such as extended storage times at port or in warehousing can support the transition to the new trade normal. Furthermore, seeking vessel calls on routes to alternate global regions not currently calling at the port can support diversification of the customer base and support to position the port for changes to trade dynamics.

- Investigate repurposing: Seek opportunities to repurpose existing infrastructure to adapt to new trade environment. For example, a reduction in container trade may result in terminal capacity that could be used for RoRo or breakbulk cargo. This repurposing can be temporary while the trade dynamics and uncertainty are allowed to settle.

- Attract impacted industry: As trade dynamics shift, countries that can be considered relative winners can attract industry. Ports with land availability for industrial co-location may become more attractive to industry that is currently producing in a country that is hit hard by the tariffs.

- Investigate refinancing opportunities: As economic growth slows central banks are likely to lower interest rates to encourage spending. Depending on existing financing arrangements, opportunities may exist to renegotiate terms.

This unprecedented trade disruption is expected to continue well into the 2nd half of 2025 as trade negotiations between the US and their trading partners continue. The change brought by the Trump administration’s approach to economic policy has instilled uncertainty into global trade. A watching and waiting approach to investment and growth is not sustainable in the longer term. This new trade ‘normal’ requires ports and logistics providers to keep their long-term goals in mind, focusing on strengthening their core business operations, whilst remaining agile in the shorter term.

At Haskoning, we are happy to support you with maintaining focus on your longer-term goals whilst making decisions in the shorter term which will remain valuable for your organisation under the vast range of future trade scenarios.